bauerhorst

UX UI Designer & Director

CASE STUDY

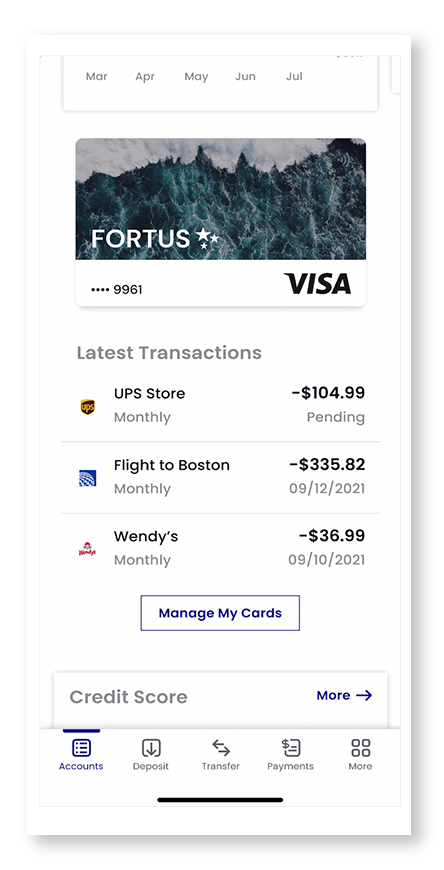

Mobile Banking App for Fortus Bank

Role:

Product Designer and Prototyper

Other Prototypers: Taylor Godsey

Background:

Given the growing demand for specialized financial services tailored to military personnel, our client, an established bank, sought to create a niche bank dedicated exclusively to the unique banking needs of military users. With a strategic focus on delivering a personalized banking experience aligned with the values and preferences of various military branches, our task was to design a mobile banking application that not only catered to specific military requirements, such as financial literacy, but also fostered a strong sense of brand alignment.

The client enthusiastically embraced our proposal, recognizing the opportunity to provide tailored financial solutions that enhance the banking experience for military personnel. Subsequently, they endorsed our designs

and expressed readiness to proceed with the development phase.

Objective:

Develop a mobile banking application tailored to meet the unique needs of veterans and active-duty military personnel. This includes providing essential banking functionalities alongside specialized features aimed at enhancing financial literacy and access to live support from financial advisors.

Solution:

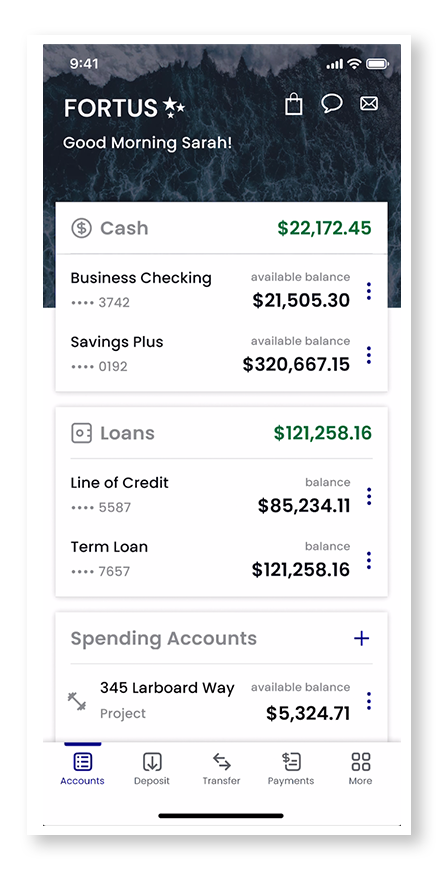

The solution involves integrating standard banking features such as a comprehensive dashboard displaying account summaries, credit scores, and transaction histories. Additionally, the application includes specialized functionalities directly accessible from the dashboard. These features encompass live support from veteran loan financial mentors/advisors, a dedicated veteran portal designed for gamified financial literacy education covering topics like savings and loans. Furthermore, the platform offers targeted marketing opportunities personalized to each user based on their credit score and engagement within the Veteran’s Portal. This holistic approach ensures veterans and military users can efficiently manage their finances while gaining valuable financial education and support tailored to their unique circumstances.

Veteran's Portal with Gamification:

The veteran's portal within our mobile banking app was meticulously designed to empower veterans through a blend of financial literacy education and engaging gamification features. Aimed at fostering financial empowerment and community interaction, the portal allows veterans to compete with friends and peers by completing various activities, such as watching tailored financial literacy videos, quizzes, and challenges.

Key features include:

Gamified Learning Experience: Veterans can earn points and badges by watching educational videos on financial literacy topics relevant to their needs, such as managing pensions, investments, and VA benefits.

Competition and Social Interaction: Through friendly competition with friends and fellow veterans, users can track their progress, compare achievements, and encourage each other to improve financial knowledge and habits.

Personalized Learning Paths: The portal offers personalized recommendations based on users' financial goals and interests, guiding them through modules that cover budgeting, savings strategies, credit management, and more.

Rewards and Recognition: Achievements are celebrated with virtual rewards and recognition, reinforcing positive financial behaviors and motivating continuous learning.

Accessibility and Support: Integrated support features provide access to financial advisors and resources specific to veterans, ensuring personalized assistance whenever needed.

This innovative approach not only enhances financial literacy among veterans but also creates a supportive community environment where they can learn, compete, and grow together financially. The portal aligns with the bank’s commitment to serving veterans with respect, dignity, and the tools they need to achieve financial security and independence.

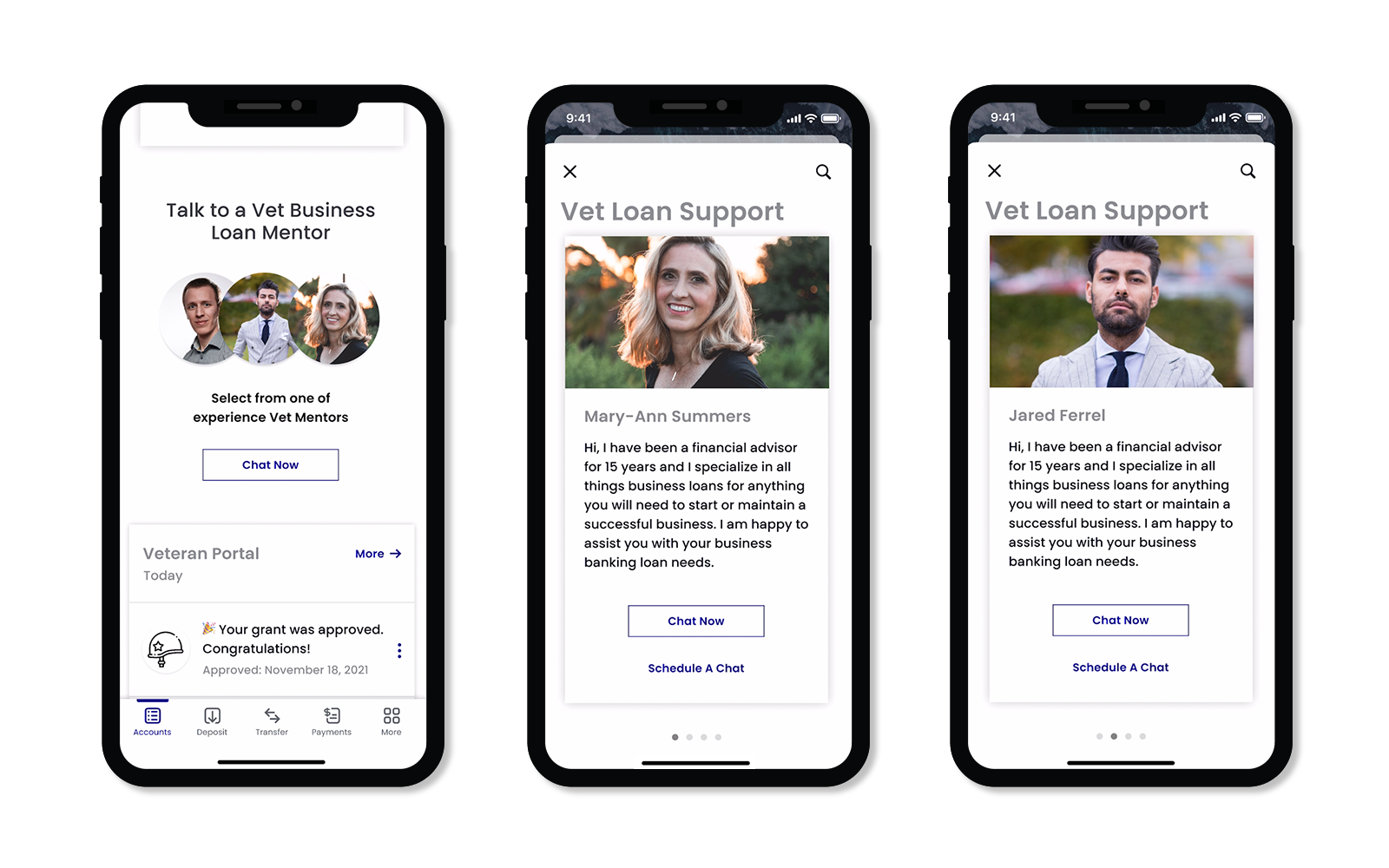

Live Chat Feature with Vet Business Loan Mentors:

The live chat feature within the mobile banking app provides veterans and military banking users with direct access to Vet Business Loan Mentors. This innovative tool offers personalized guidance and support for veterans seeking business loans, fostering a seamless and supportive environment for financial empowerment.

Key features include:

Direct Mentor Access: Veterans can connect in real-time with experienced mentors who specialize in navigating business loan options tailored to military personnel.

Tailored Guidance: Mentors provide personalized advice on loan application processes, eligibility criteria, financial planning, and strategic business development.

Interactive Support: Users can ask questions, receive immediate responses, and engage in informative discussions to address their specific financial needs and goals.

Confidentiality and Trust: The chat platform ensures secure and confidential communications, promoting a safe environment for veterans to discuss sensitive financial matters.

Integration with Resources: Mentors may direct users to additional resources, workshops, or networking opportunities to further support their entrepreneurial endeavors.

This feature exemplifies the bank’s commitment to empowering veterans through accessible, expert guidance, enabling them to make informed decisions and achieve their business aspirations with confidence.

Prototype

UX/UI Design

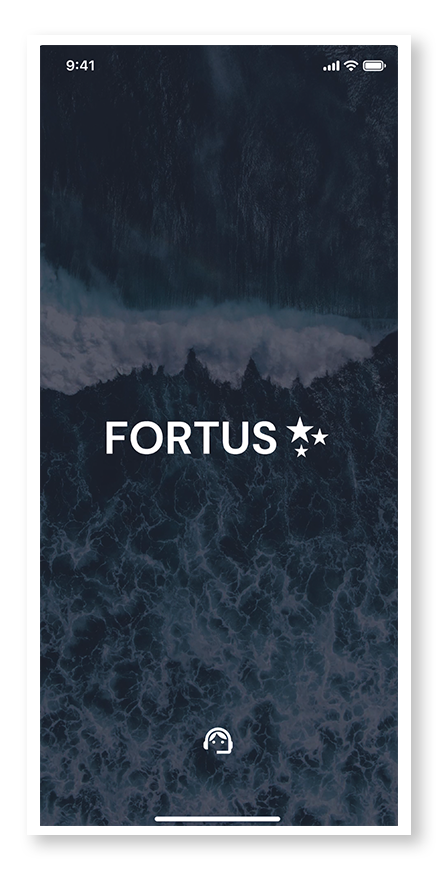

Each military branch receives their own branding, on the login screen,

header image and for their debit and business cards.

The images are carefully selected, to match their military branch, without invoking memories of combat.

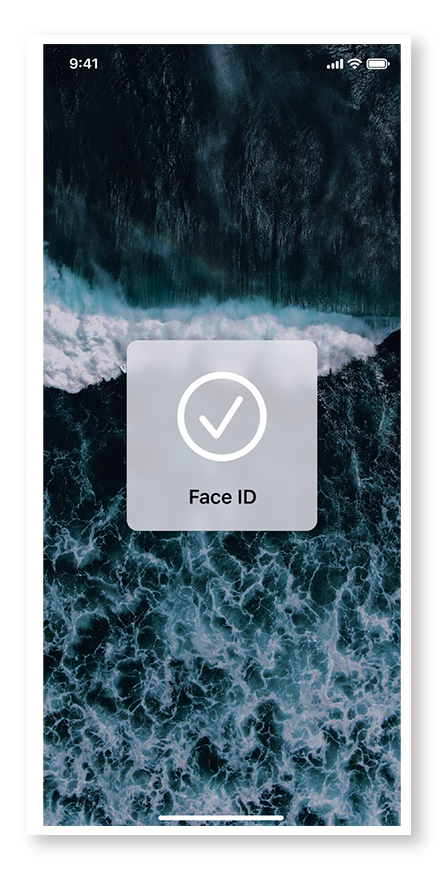

Login and Dashboard Design

For the Login, I removed the content for username and password,

because the user has opted to sign in with their Face ID. Once an error arises,

the regular Login screen with username and password appears.